Real estate loan in Dubai : our solutions

If you want to invest in real estate in Dubai, you will certainly be interested to discover the credit options available to you. Classic" or "Islamic" loans, the choice is yours. As a French real estate agency based in Dubai, Dubai Immo has partnered with Dubai's largest mortgage broker.

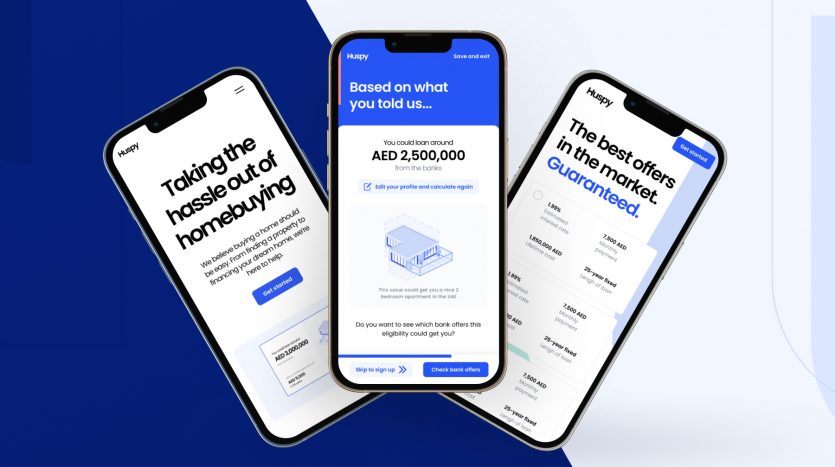

Real estate loan in Dubai with Huspy

Dubai Immo (Elysee Vendome Real Estate) is the number one French real estate agency in Dubai. On its side, Huspy is the most important real estate broker in Dubai. It was therefore only logical that our two companies should join forces. Access to credit is now easy for non-residents, thanks to Huspy's partnerships with the largest banks in Dubai. Thus, non-resident investors, regardless of their nationality, can obtain a real estate loan in Dubai.

Real estate credit conditions in Dubai

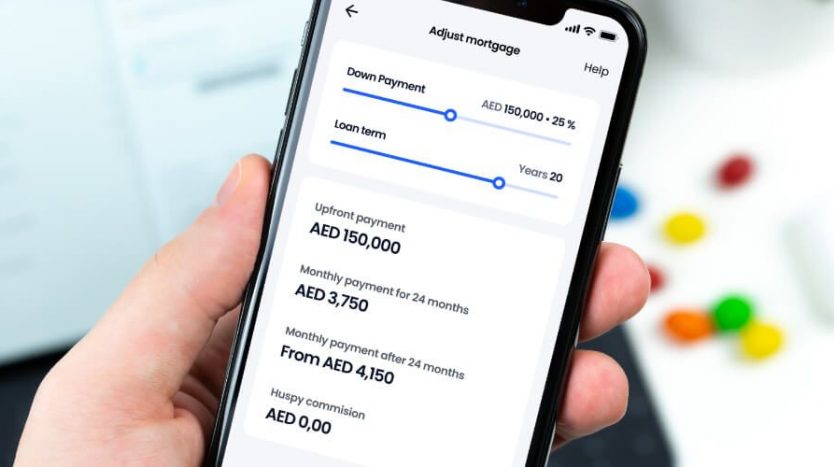

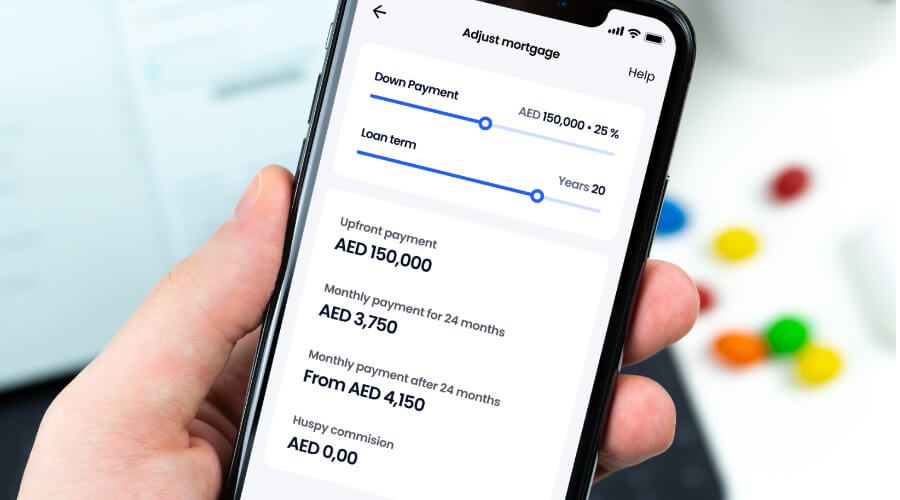

If you wish to make a real estate loan in Dubai, you should know that it will be possible to borrow up to 75% of the price of the property, if you have no outstanding credit. If you have outstanding loans, it will be possible to borrow up to 50% of the property price. Whether you are self-employed or employed, you can borrow in Dubai to buy a villa or an apartment. You must be at least 21 years old to obtain a loan in Dubai, and the maximum loan period is 25 years. There is no maximum amount, it will depend on the income and profile of the borrower. The minimum monthly income to be eligible for a mortgage in Dubai is AED 15,000 or €3570 net/month.

Mortgage rates in Dubai

For non-resident investors, the loan rates will be around 3%. The rate is not fixed and will generally be reviewed after 3 years, depending on the evolution of the rates set by the Central Bank of Dubai. The rate of your loan can therefore go up or down, as is also the case in Europe.

Documents required to obtain a mortgage

To obtain a pre-approval, you will need to provide the following documents to your professional Dubai Immo real estate agent, who will then forward them to the broker:

- Scan of your passport

- Scan of your ID

- Scan of your last 6 pay slips

- Scan of your last tax statement

- Scan of your last 6 bank statements

- Scan of a proof of address

These documents must be translated into English.

Real estate eligible for purchase on credit

Only properties whose construction is completed can be financed by a Dubai bank, up to a maximum of 50%. At the time of approving the loan, you will have to go to Dubai to sign the documents, open the bank account with the bank that will grant you the loan, etc.

The best areas in Dubai for real estate loans

To validate a real estate loan, the bank will make its own estimate of the value of the property, being very prudent and conservative. Thus, some neighborhoods make it easier than others to obtain a mortgage. In February 2022, the neighborhoods in which it was easiest to obtain a mortgage were

- Dubai Creek Harbour

- Damac Hills

- Dubai Hills

- Downtown